Taxpayers who filed their 2022 income tax return can now check if they were included in the fourth installment of refunds.

In total, the lottery will be paid in the amount of 4,462,564 taxpayersThe total amount recovered is R$6 billion. resources will be deposited this Wednesday (31).

The consultations on the so-called remaining lots from previous years, i.e. taxpayers who fell into the fine net but later settled accounts with Assad, were also released.

The fifth and final installment of refunds will be paid on September 30th.

Inquiries can be made:

IR 2022: Find out how to consult your refund quotas and see the calendar

Of the total amount of the payment, R$265 million will be paid to taxpayers Legal priority:

- Elderly people over 80 years old (7,855 people)

- Taxpayers between the ages of 60 and 79 (60,575)

- Taxpayers with any physical or mental disability or serious illness (5,514 people)

- Taxpayers whose main source of income is teaching (25,854 people)

There were also 4.3 million non-priority taxpayers who had filed the declaration by May 30.

The refund shall be paid directly to the bank account indicated in the advertisement, either directly or by referring to the PIX key.

If the credit is not performed (for example, the reported account is deactivated), the amounts are available for refunds for up to one year at Banco do Brasil.

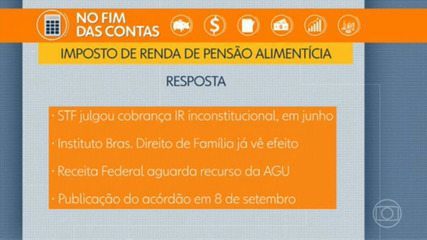

Income tax has days counted for alimony

The taxpayer, when conducting the consultation, will be able to find out whether there are outstanding issues that prevent the payment of the refund or not, that is, whether he has fallen into the so-called “micro-net”.

To see if they are in the exact network, taxpayers can also access the income tax “statement” on the website of the tax authority on call e-CAC (Virtual Service Center).

To access the IR statement, it is necessary to use the access token generated on tax authorityor a digital certificate issued by an authorized authority.

Refunds for statements showing inconsistency (in the case of a network) are released only after their correction by the citizen, or after the taxpayer provides evidence of the correctness of his statement.

“Friendly zombie guru. Avid pop culture scholar. Freelance travel geek. Wannabe troublemaker. Coffee specialist.”