For Nobel Prize-winning economist Angus Deaton, the wealth tax is not a good way to pay off pandemic debt, and if it were introduced, it would likely be permanent.

Deaton, a professor at Princeton University who is preparing the official study on inequality in the United Kingdom, said.

A growing number of wealthy politicians are demanding a greater share of the record debt burden that governments carry to sustain the economies hit by the Covid-19 virus. The International Monetary Fund stated that Prof. Temporary tax It would help alleviate the social inequalities that have been exacerbated by the pandemic.

The author of “Deaths of Despair,” co-authored with his wife, economist Anne Case, said in an interview that a single tax on wealth “is likely to be permanent,” as was the case with the income tax. The United Kingdom imposed an income tax to finance the Napoleonic War, which is now one of the most important sources of income.

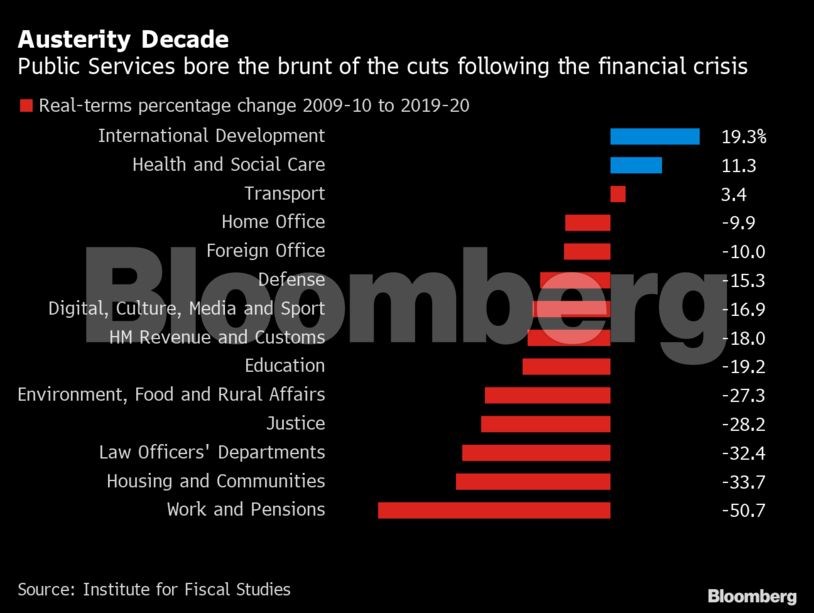

After a decade of British government austerity in the wake of the financial crisis, Dayton also recommended against cutting social services, warning that advocates of fiscal austerity were causing disaster by reducing funds for health and education.

Deaton is leading a panel of experts in the UK looking at how to reduce inequality, as young people and those with less education increasingly fall behind the rich. The Institute for Tax Studies plans to publish the results of the analysis in 2023.

The pandemic has already exacerbated trends in the United States and the United Kingdom, Dayton said. On the one hand, education has become a more specific variable in people’s lives. Additionally, unemployment is now less useful as an indicator of economic health. While recovering from the recession caused by the pandemic creates jobs, Dayton said more and more people will be forgotten.

“In economic expansions, it is always increasing, but it never increases as much as the previous peak,” Deaton said.