Bob Sternfels is Global Managing Partner From McKinsey – a position equivalent to the global CEO of a consulting firm. Having worked at the company for nearly 30 years, the CEO rose to the position of global leader at the height of the pandemic, in March 2021.

Sternfels has spent much of his career in manufacturing practice. For this reason, he has closely followed the strangulation of global production chains during the pandemic. Now, the executive believes that China’s slowing growth should encourage trade diversification, which could be an opportunity for Brazil.

However, there is no trend more important to him than the advancement of generative artificial intelligence. According to studies conducted by McKinsey, there is the potential to increase the UK’s GDP annually from the productivity generated by artificial intelligence in businesses.

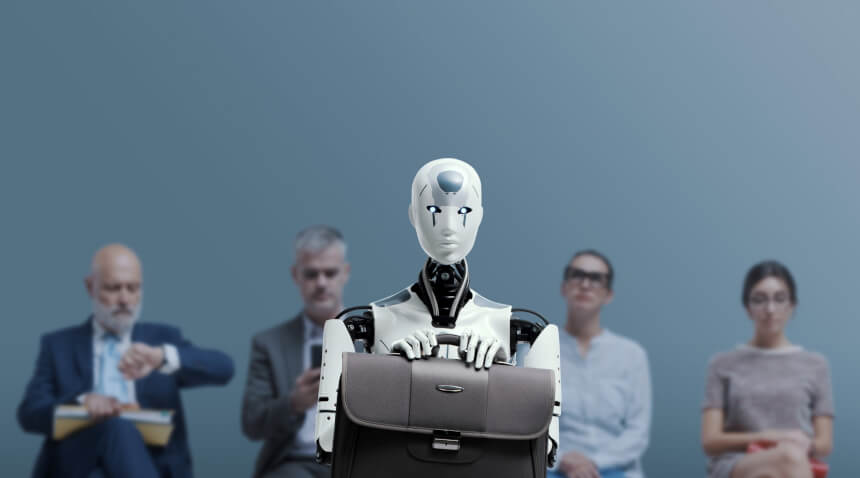

Contrary to common sense, Sternfels believes that AI will not threaten jobs.

China will lose 150 million workers by 2050. Europe, Japan and Korea are also shrinking. Even Brazil begins to shrink within 20 years. Then we would have a world with the opposite problem, with a shortage of talent.

Goldman Sachs forecasts that global investment in AI could reach US$100 billion by 2025. How do you assess the extent of adoption of this technology by major companies around the world?

First, that is Converts The giant technology that changes everything. In addition to the necessary investment, I want to talk about the potential returns.

We worked in our global institute that looked at 63 very specific use cases, across different industries. So, if we look at each sector individually, if you apply generative AI to the most valuable parts of the business, what is the value of that? We estimate $3 trillion to $4 trillion in additional global revenues each year. This is equivalent to the size of the UK economy.

So, there’s another potential UK economy to get revenue from the investment of about $100 billion that you mentioned. I think it’s also important to think that this is not just a cost, but a return on investment that can transform a business.

Artificial Intelligence is on the minds of every CEO around the world. Everyone is asking questions about how to adopt generative AI and there will be a race on it.

Not every investment will be a good investment, so there will be a lot of money wasted in the process. But focusing on the highest-return areas can separate the winners from the losers. Therefore, the important thing is to focus efforts on the areas of greatest value.

The second idea is that it’s not just about technology, it’s also about people. How to train the workforce? We did a study where maybe 40% of the workforce needed to reskill to use generative AI capabilities. This is a huge effort to train people. Furthermore, what would the organizational model be like in this scenario? Will organizations become flatter?

The winners will be those who think of all these things. They will think about the areas that will ensure the greatest return on investment. They will try to empower the workforce from day one and will focus on redesigning the organization to achieve maximum value.

Brazil has as good a chance as any other country to lead the application of this technology. But this window is shorter.

But is AI actually making real gains or is there still a lot of experimentation that will only lead to gains in the future?

It’s happening now.

If we look at some very specific industries, like insurance, claims and underwriting processes are changing now. The way risk is calculated is now driven by generative AI.

McKinsey itself is rethinking how teams actually work. We’ve launched our own version of generative AI for internal use called Lili, and it dramatically reduces the time people used to spend. It’s not just talk, it’s real.

One of the biggest uncertainties is the impact of AI on countries’ productivity. Data from the US economy show that in the 1980s and 1990s, the effects of computer dependence on the country’s productivity became apparent only after more than half of businesses had adopted the technology. Do you think the impact of AI on the global economy depends on mass adoption?

Well, these were network-based technologies where the counterparty had to use the same technology. Think about the Internet: If you are online and I am not. This doesn’t help much.

The difference with generative AI is that if a company adopts this and changes its operations, it will have a significant advantage over all of its direct competitors.

So I think the generative AI curve will not resemble the technology adoption process in the past. I think the generative AI curve will reach saturation point much faster. When your competitor has an advantage over your business, you will move quickly to close that gap, rather than wait and see and then act.

The other part of that is that some of these technologies require a lot of infrastructure changes, like moving to mobile, moving to the cloud, and a complete overhaul from the point of IT.

Generative AI is more than just plug and play. It is a more democratic technology and can be implemented in specific locations, which facilitates progress from a business point of view.

But how do you create the right incentives for AI adoption?

I think this is where we can see a lot of innovation in collaboration with the public and private sectors. There will be better paying jobs as the pay differentials within companies will start to decrease as you are raising entry level salaries. But again, this requires a huge investment in skills.

So can we start to innovate on how to create the right incentives for companies to invest in upskilling? Likewise, the government can start offering different educational opportunities to start learning generative AI now. That’s my big concern: skills.

One of the biggest debates is how to ensure employment opportunities for humans. What will the workforce of the future look like?

I think the discussion is not about eliminating jobs, but about redefining them.

What you can do with generative AI is ten times what you could do before. We will eliminate many tasks that were a burden on productivity. When you look at the world as a whole, what is actually happening is that we are facing demographic pressures.

China will lose 150 million workers by 2050. The number of workers in Europe, Japan, and Korea is also shrinking. Even Brazil will begin to shrink within 20 years. Then we would have a world with the opposite problem: a talent shortage. We’re going to have to get more from each of us. I think generative AI is one way to do this so that we don’t have to compromise on growth. Even if demographic trends are against us, we can make each of us more productive.

Strategists have been warning investors about a world with 5% interest rates, which was the norm before the 2008 crisis. What will be the impact on companies and private investment?

Interest rates of 5%, for example, and inflation of around 3% affect all sectors. After all, practically all sectors benefited from free money.

Well, with a 5% rate, the money is no longer free, and this increases efficiency. Those who do better will stand out more. What we typically see in environments like this is greater variation in performance within the same sector. The best companies compared to the average will have a greater difference in terms of performance. When money is free for everyone, everyone rises together.

Now, if you’re a CEO and you’re looking at a 5% interest rate environment, we’ll go back to talking about flexibility, because it’s hard to operate in that scenario.

But what does it mean to be flexible in a world of 5% interest rates?

I like to sum it up with a sports analogy: it’s the ability to play offense and defense at the same time. How do you make sure your company has enough protection and scenario planning to withstand future shocks? But you don’t just play defense.

We did some calculations, where if a company went through a very difficult period, where interest rates were at 5% for a long time, and they just played defense, the good news was that they had an 80% chance of surviving. The bad news is that this company will definitely be only average.

On the other hand, if this company only played an offensive role, the good news is that if it survived, it would have a good chance of becoming number one. The problem is that the probability of it breaking was 70%.

Therefore, this is very risky. But companies in the middle group, which were balanced between offense and defense, outperformed their peers by 30% in terms of total stock value.

But what is the most common situation among companies today?

In general, companies are out of balance – one way or another. They overinvest in balance sheet productivity, but they don’t actually make bold bets on AI or new technologies.

We also see companies making all the bold bets at the same time, but they won’t be able to withstand the next shock that comes. There is a way to objectively assess whether you are in balance, and whether your set of initiatives is equal between attack and defense. I think this is one of the secrets to navigating an environment that will be more challenging in the future.

In the second part of interview, Bob Sternfels talks about China’s slowdown and Brazil’s opportunity “Green Support”.

Fabian Stefano

“Friendly zombie guru. Avid pop culture scholar. Freelance travel geek. Wannabe troublemaker. Coffee specialist.”