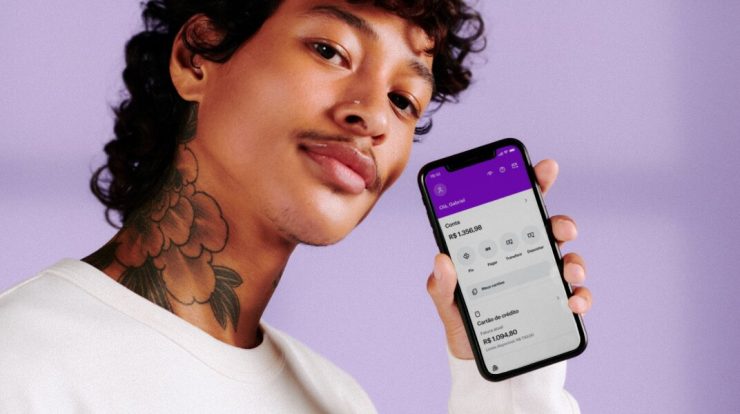

a nubank In February last year launched an interesting feature for customers who can not limit. However, the user himself can choose how much he wants to spend on Credit cardup to a maximum of R$5,000.

Read more: 5 tips to win in Mega da Virada used by most bettors

The option to create a limit is a good option for consumers with a negative name or a low score. according to financial technology, When used correctly, it improves the customer’s relationship with the bank and increases their chances of achieving the pre-approved limit in the future.

Build a limit on the card

The feature is very simple: just keep the amount that will be used for credit card purchases from the balance of the digital account. If a person wants to buy a product for R$200, for example, just deposit the same amount into the account and keep it as the card limit.

at the end of one month, nubank will generate an invoice. After paying the document, the user will be able to choose whether they prefer to leave the amount reserved as a maximum, or whether they want to redeem it back into the account.

If necessary, he can use his reserve to pay his bill, but the bank recommends keeping the amount as a maximum. And be aware: If the bill isn’t paid by the due date, the bank can use the reserved funds to settle the debt.

Step by Step

The function is available in the Nubank app, in the card menu. Here’s how to create the threshold:

- access to the Nubank app;

- Enter the “Credit Card” menu;

- Click “Set Limit”;

- Select the “Reserve Limit” option and enter the required amount;

- Confirm the operation.

“Friendly zombie guru. Avid pop culture scholar. Freelance travel geek. Wannabe troublemaker. Coffee specialist.”