July brings a great advantage to Brazilian workers who have accumulated funds in the FGTS (Service Time Guarantee Fund). The Christmas withdrawal method allows you to access part of these resources, providing additional financial liquidity. Therefore, many people wonder how this type of withdrawal works and its advantages. In this article, we will explain how you can take advantage of this opportunity.

The Birthday Withdrawal is an alternative to traditional FGTS withdrawals, which can generally only be made under specific circumstances, such as the acquisition of real estate or other cases provided for by law. However, with this method, interested parties are free to withdraw a portion of their FGTS balance each year, in the month of their birth and in the following two months.

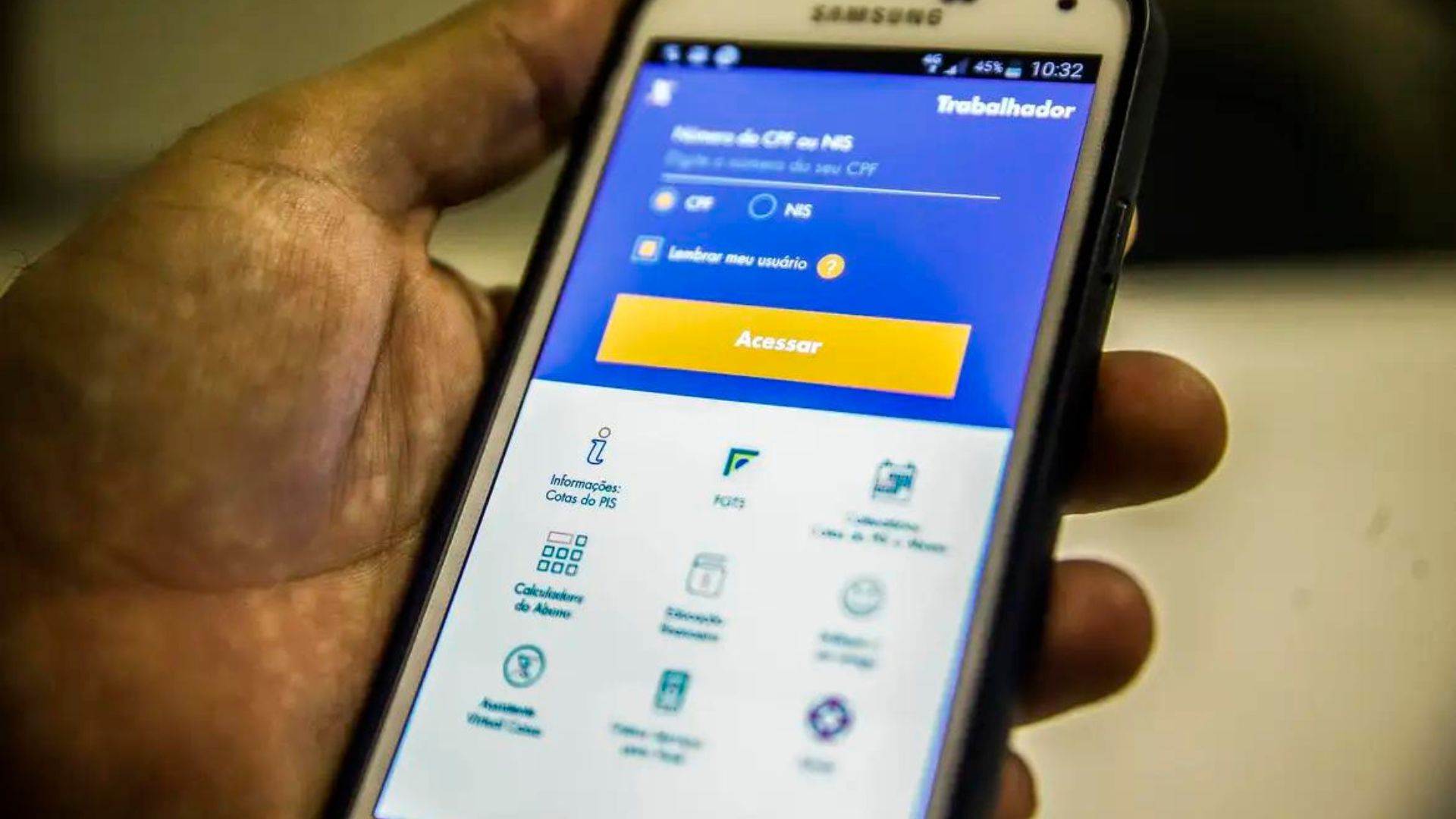

How can I join Saque-Anniversario?

Participation in this method is simple and can be done in two main ways: through the FGTS application or directly at the federal branch of Caixa Econômica. Using to requestSimply follow a few quick steps to complete your membership, choose the “Christmas Withdrawal” option and accept the proposed terms. an agencyFace-to-face service makes it easy to resolve any queries directly with the employee.

When can I make a withdrawal?

FGTS birthday withdrawals are scheduled according to the worker’s birth month. For those with a birthday in July, for example, the withdrawal period runs from July 1 to the end of September, providing flexibility in planning your use of funds.

Benefits of Choosing a Christmas Draw

When choosing this method, the worker still retains the guarantees offered by the FGTS, such as a 40% penalty in the event of unfair dismissal. Although there is a waiver of the full withdrawal of the balance upon dismissal, this option still allows the worker to use the balance in specific cases, such as when purchasing real estate and in times of retirement or serious illness.

What amounts are available for withdrawal?

- Balance up to R$500: Withdraw 50% of the amount.

- From R$500.01 to R$1000: Withdraw 40% + additional R$50.00.

- More than R$1,000 up to R$5,000: Withdrawal 30% + additional R$150.00.

- Thus, the additional amount increases up to R$ 2,900.00 for balances greater than R$ 20,001.

These ratios allow each operator to better plan his annual investments and expenses, ensuring a financial extraction that can be repeated every year, always according to the balancing ranges provided.

With this alternative offered by FGTS, it is important that each beneficiary remains aware of the specific dates and rules, in order to make the most of the opportunities offered by Christmas Cash. The information provided here seeks to help you make more informed choices and improve your annual financial health.

“Friendly zombie guru. Avid pop culture scholar. Freelance travel geek. Wannabe troublemaker. Coffee specialist.”