Hey Nubank It was born with the proposal to simplify everyday life and give people control of their financial lives. Part of this mission is to facilitate access to credit, which is why the bank has several types of credit lendto meet different needs.

Currently, Nubank has Personal Loan Types, Secured Loans (from Conserved Funds or Direct Treasury), NuConsignado for Federal Public Service Employees, and FGTS for Christmas Advance Withdrawal.

Check below for more details and information about each type of loan Nubank offers, as well as instructions on how to apply for each.

personal loan

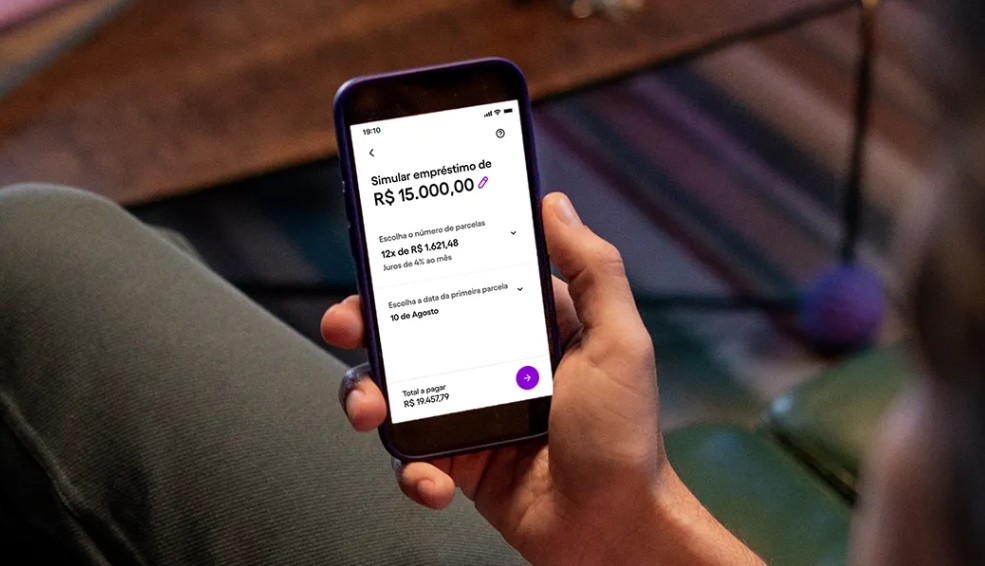

In the Nubank application there is the possibility of simulating andpersonal loan Real-time: Within the amount pre-approved by the bank, you can enter the amount you need, choose the number of installments, and instantly see the interest and total monthly amount you will pay.

During the simulation, you choose the first payday. It can be up to 90 days after the contracting day and the installment period is up to 24 installments. It is worth noting that the higher the number of installments, the higher the interest rate.

How to order

- On the app’s home screen, tap Borrow;

- After reading the instructions, click on “Calculate Loan”;

- Choose a reason;

- On the next screen, enter the amount you want to borrow, choose the number of installments and the date of payment of the first installment;

- In the lower left corner, click the arrow;

- Review your loan information and click “Continue”;

- After reading the contract, click “Confirm Employment”.

- Enter your 4-digit password and that’s it! The required amount is transferred directly to your Nubank account.

NuConsignado

Hey NuConsignado For Federal Public Service Employees Available to certain Nubank clients who fall into this category of workers.

With a salary loan, the interest is lower and the installments are automatically deducted every month from the salary slip (paycheck). In the option intended for public sector employees, the loan can be repaid in up to 96 instalments.

How to order

- On the main screen of the Nubank app, tap on the “Loans and Salaries” section;

- Then click “I want to emulate” in the NuConsignado section;

- Select your profile of the addressee – “Federal Employee” and click “New Contract”;

- At this point, you will need to access your account SouGov.br To allow Nubank to access its allocated margin;

- Run the simulation by entering the amount you want to borrow;

- Choose the number of installments to be paid in;

- After checking the interest, terms and total loan amount, simply confirm with your 4-digit password;

- At this point, you will need to access your SouGov.br account again to approve the contract – that is, approve it;

- After approval, the required amount is transferred directly to your Nubank account.

Loan with guarantee

like A loan with saved money as collateralThe amount you have saved within the planned redemption function can be used as collateral. Depending on the amount you have saved in the planned redemption of your Nubank account, we may offer you credit amounts. This way, you will not need to use your reserves and the money will continue to generate income.

Payment can be made in up to 24 installments – the first installment can be paid within 90 days after contracting.

actually Loan with Tesouro Direto as collateral Nubank offers a loan amount of up to twice the amount used as collateral – with loans that can reach R$150,000.

In this method, the client does not need to choose to recover the investment, as he suffers from the possibility of its value declining. Direct Treasury bonds continue to be invested and return earned until the end of the loan.

How to order

- On the home screen of the app, access the loan option;

- Determine the purpose of your loan;

- Then click on “Learn more about our loan with saved funds” or “Loan with investment as collateral”;

- To learn more about the warranty, see the link “How the warranty works”;

- Continue the simulation as many times as you want;

- View your loan summary with detailed amounts;

- Continue to review and contract your loan;

- Once the process is completed, the funds will go to your account.

FGTS Down Payment Loan for your birthday

a Expect FGTS Birthday Withdrawal at Nubank It is a type of loan for anyone who needs money for an emergency or to get a plan going, whether for home renovation, paying an overdue bill, buying a car, or any type of unexpected event.

In this type of loan, it is possible to make up to 12 “annual draw” installments and the balance of your FGTS (Time of Service Guarantee Fund) is the payment guarantee. In other words, you have the amount available within one business day, directly into your Nubank account, without having to wait for your birth month every year to withdraw it.

How to order

- On the app’s home screen, tap Borrow, just below your Nubank account information. or In the “Loan” area;

- On the FGTS Birthday Draw application screen, you can click on “Learn How to Authorize” if you want to know the step-by-step guide on how to navigate the FGTS application (if you have already registered for the Birthday Draw and have already authorized Nubank, you can Click directly on the little purple arrow at the end of the page, without having to go to the FGTS application);

- On the next screen, if you have not yet joined an authorized Saque-Aniversario or Nubank, click on “Go to FGTS application” and follow the instructions to authorize the advance payment; If you have already joined Saque-Aniversário and have already authorized Nubank in the FGTS application, click on “I have already authorized”.

If you are using the FGTS app, when you return to the Nubank app, review the flow again and click Already Authorized. immediately:

- Enter the amount you want to pay by clicking on the pencil icon;

- Choose the number of Christmas Draw installments you want to pay in advance;

- Check the simulation summary and click Continue;

- Read the contract information carefully and then click “Accept and Contract”;

- Enter your 4-digit password, and you’re done!

- It can take up to one business day for the funds to arrive in your Nubank account.

To receive more news about finance and social benefits, join our groups on Facebook, cable that it WhatsApp.

“Friendly zombie guru. Avid pop culture scholar. Freelance travel geek. Wannabe troublemaker. Coffee specialist.”