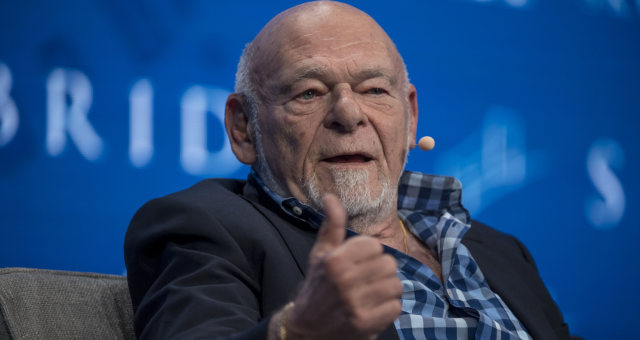

Billionaire Sam Zell sees inflation everywhere and buys Go As a hedge. He says the same strategy other investors used that he was criticizing.

“Obviously, one of the natural reactions is to buy gold,” he said in an interview with Bloomberg TV. “It’s funny, because I spent my career saying, ‘Why do you want to get gold?’ You don’t have a cost of holding it. But, when you see a devaluation of the currency, you will say, Where am I going to stay?”

Zell, 79, said he not only cares about the dollar but also the other countries that print money, and wonders if inflation will be temporary, as the prime minister indicated last week. Federal ReserveAnd the Jerome Powell.

“We see it everywhere,” said Zell of inflation. “You read about the price of timber, but we see it in all of our business. Obvious bottlenecks in the supply chain are driving up prices. It reminds us a lot of the 1970s.”

Zell, who in 2019 formed a joint venture with Tom Barrack Jr. Colony Capital to invest in oil and gas, said that while gold is an attractive investment, the opportunities in fossil fuels are not.

“At the present time, the price of oil and gas does not reflect the risks of what is happening, whether in the world of electric cars or in a world characterized by climate change,” he said. “A few years ago, I thought the risk-reward ratio was appropriate. It has clearly become very inappropriate, as our political situation has changed.”

Zell also said he was concerned that renewable energy could damage the reliability of the grid, citing recent blackouts in California and Texas.

In the interview, Zell said that in the real estate market, there are many questions about how to demand in the next two years in the office, housing and retail sectors.

“Everyone is interested in going back to work and filling the offices.” He said “I don’t really think this is a problem.” The problem is that, before the pandemic, we were dealing with an oversupply of offices. It is clear that the epidemic has not reduced this oversupply and may have encouraged it accordingly. .

He explained that stores also present challenges, as the United States already had greater retail space per capita than the rest of the world before Covid-19, and customers increased e-commerce use during the pandemic.

“Street retail today is like a falling knife and you don’t know how far it’s going,” he said. Although this “does not mean that the best malls will not perform well,” there are “an enormous number of features that have to be reprogrammed one way or the other”.

Zell said the challenges facing hotels will be a temporary problem for the next three to four years. “We will see a slow recovery in business trips,” he predicts. “Meanwhile, the recovery will be slow, and hotels represent significant overheads and operating with less than ideal occupancy is a very costly scenario.”