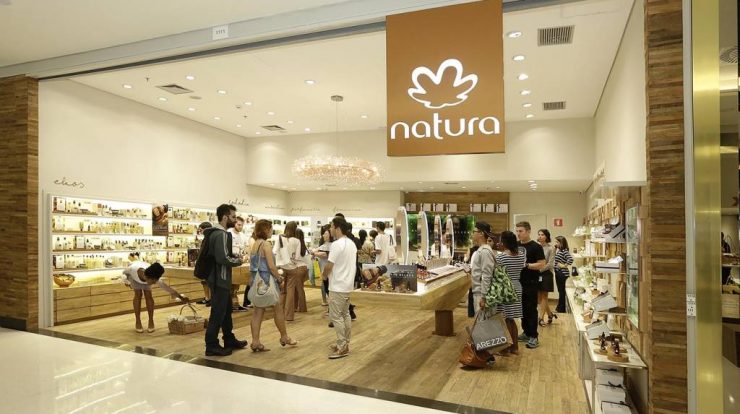

Natura Store (disclosure)

Sao Paulo – Natura (NTCO3) reported, in a key fact on Thursday (11), that it has begun studies to strengthen its global presence by changing its primary listing to the New York Stock Exchange, while maintaining dual listing through B3-listed BDRs (B3SA3).

The fourth largest beauty group in the world, with operations in more than 100 countries, the company stated that the board of directors authorized the operating committee of the group to study and make a recommendation for listing on the US stock exchange.

To make this process feasible, the company has informed that it is considering setting up a new holding company for the group, preferably one based in the UK, where the group already has a suitable presence and where The Body Shop and Avon are headquartered.

In addition, he indicated that Natura Cosméticos will continue to have its headquarters and headquarters in Brazil and Aesop in Australia.

New York Stock Exchange List Study Details

According to Natura, the proposal under consideration assumes that the company’s shareholder base will transition to a new holding company, through an international corporate restructuring.

Thus, he said, the company intends to maintain a “one share, one vote” ownership structure.

“There is no guarantee that the board of directors will submit a proposal to restructure the company to the company’s shareholders upon completion of the studies,” he added.

He added that “any proposal for restructuring will be subject to the approval of the majority of the existing shareholders present at the shareholders’ meeting, in accordance with the Novo Mercado Regulation.”

Finally, Natura emphasized that in the event of final approval of the potential reorganization by the company’s shareholders, the dissenting shareholders would have the right to exercise their rights of withdrawal under Brazilian corporate law.

Natura’s overseas expansion

In fact, the company highlights that it is “proud of its Brazilian heritage and origin”, but now gets more than 70% of its revenue outside Brazil, after acquiring Aesop in 2013, The Body Shop in 2017 and Avon in 2020.

“Following the recent successful capital restructuring, which we believe places the group in an investment rank in the near future, the potential reorganization of the company will be a new step in the group’s strategic planning to continue to access global markets and investors, while continuing to be committed to the markets in which we operate through business units. and our subsidiaries. These will remain domiciled in their existing jurisdictions,” the company stated in substance.