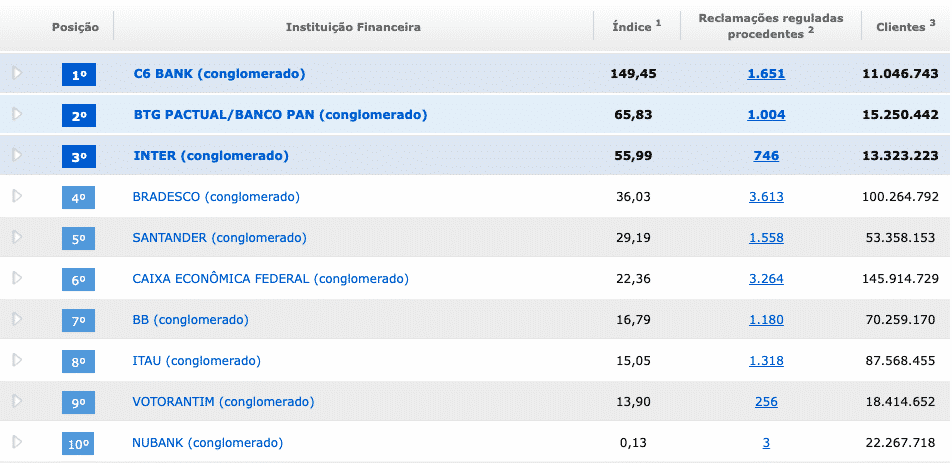

The order of complaints consists of requests from the public registered in the service channels of the Central Bank: Internet, BC + Perto application, correspondence, in person or by phone (145). In short, co-rank, and Banks Commercial banks, multi banks, cooperative banks, investment banks, branches of foreign commercial banks, savings banks, companies creditand Finance and Investment (SCFI) and Union officials. In this list, the file nubank Popped in the ranking. Find out why below.

C6 Bank tops the ranking of central bank complaints

Central Bank Complaints Arrangement

In the ranking lists, information about complaints against participating institutions is provided. Briefly, according to the Central Bank, these complaints are classified as follows:

Regulated claims are valid: The number of incidents (violations), related to closed complaints in the reference period, for which there was evidence of non-compliance by the institution with a law or regulation whose supervisory competence belongs to the Central Bank of Brazil.

censored – others: The number of incidents related to closed complaints in the reference period, for which there was no evidence of non-compliance by the institution with a law or regulation whose supervisory powers are subject to the Central Bank of Brazil.

disorganized complaints: The number of facts, related to complaints closed in the reference period, that are not related to the law or regulations whose supervisory competence is the Central Bank of Brazil.

Total complaints: The value obtained by adding structured claims and regulated claims – and other claims and unstructured claims.

The events in the ranking lists refer to complaints closed in the period. Complaints may aim to register more than one case. Institutions are ranked in the ranking lists in descending order of the complaints index which is calculated according to the following formula:

Complaints Index = (Adjusted Complaint Handling * Multiplier)

Number of clientsThe multiplier is 1,000,000.

Why does Nubank stand out?

Nubank stands out in the ranking of complaints received from the central bank, as it appears last in the ranking of complaints received from banks and finance companies. On the other hand, the C6 . Bank Ranking leader:

Regarding the indicator, it indicates the number of valid regulated complaints, divided by the number of customers, and multiplied by 1,000,000. On the other hand, valid structured complaints refer to the number of facts/infractions, associated with closed complaints in the reference period, in which there is an indication of non-compliance, by the institution, of a law or regulation whose supervisory competence is the Central Bank of Brazil.

Finally, for clients, there is the total number of clients in the aggregated base of the National Financial System (CCS) and Central Bank Credit Information System (SCR) clients registry. Thus, Nubank is the financial institution that ranks tenth in the ranking of complaints. However, the financial technology Stand out against big competitors like C6 Bank and Banco Inter.

NSAnyway, do you want to know more about everything that is happening in the financial world?

So follow us no youtube channel And on our social networks, like Facebook social networking siteAnd TwitterAnd Twitch NS Instagram. So, you will follow all about digital banks, credit cardsAnd loans, fintechs and biz matters.

Photo: Miguel Lagoa / shutterstock.com