Spoiler: Brazil appears in the study. Find out what calculations you need to do for a quieter retirement

How old do you want to retire? For a large part of the population, the more the better. According to the report Live Longer, Better: Understanding Lifelong Literacy, released by the World Economic Forum in partnership with consulting firm Mercer, half (44%) of interviewees under 40 expect to retire before age 60.

In addition to age, there’s another factor that can make retirement more fulfilling: where you live for the rest of your years. In its tenth edition, the study by Natixis Investment Consulting has shown, precisely, the best countries to retire to. 44 countries were evaluated based on several factors, such as quality, life expectancy, and health system.

Best states to retire

Norway comes out on top, with a quality of life index for retirees at 81%. Switzerland, Iceland, Ireland, Australia and New Zealand also rank.

Out of 44 countries, Brazil ranks 43rd – just ahead of India (44th). Places like Chile (34th), Mexico (36th), and Colombia (42nd) also make the list.

The study, released at the end of 2022, still rates last year as “bad for retirement,” due to high inflation rates around the world.

According to Natixis analysis, food, housing and even oil prices are eroding the purchasing power of those who intend to retire soon.

Check out our list of the ten best countries to live in when you retire below:

Retirement requires planning

And what should be considered for retirement?

“It is possible to retire before the age of 60, as long as you started contributing before the Social Security reform introduced in November 2019 and comply with the transition rules that were created,” explains Maria Faiock, a lawyer specializing in social security law. The ideal is to conduct a study to check the tire on all bases.

“Retirement planning, both for those who already contributed to social security before the reform and for those who started contributing afterward, is a crucial factor in ensuring a more peaceful and secure future,” Maria stresses.

Rule 1-3-6-9

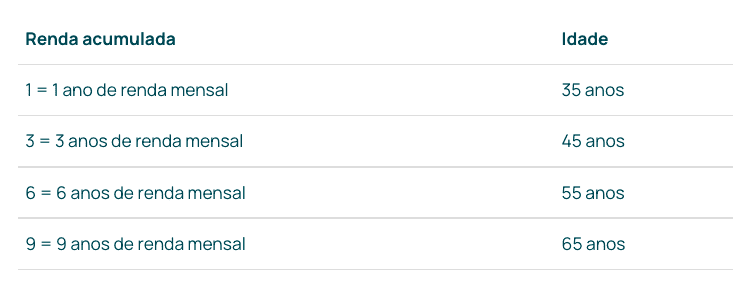

In this context, the private pension comes as a complement and diversification of income sources in retirement. And faster is better. The 1-3-6-9 rule, developed by financial planner Martin Iglesias, tells you how much you should save for each stage of life.

At age 35, for example, the rule suggests a financial reserve equal to one year of your monthly income. Already at the age of 45 it is necessary to have the equivalent of 3 years. Martin points out that the base works like a road, with checkpoints over time.

“Friendly zombie guru. Avid pop culture scholar. Freelance travel geek. Wannabe troublemaker. Coffee specialist.”