The law amending the Consumer Law and setting up a series of measures to avoid so-called “over-indebtedness” came into effect last July.

Law 14.181 / 21 Kan With the approval of President Jair Bolsonaro on Friday (2). Is he there It increases the protection of those who have a lot of debt and cannot pay it, and creates some tools to contain excesses in the supply of credit.

Among the new rules, consumers will be entitled to some kind of judicial recovery to renegotiate debts with all creditors at the same time. The law also prohibits any kind of harassment or pressure to seduce consumers.

The bill defines excessive indebtedness as “the apparent impossibility of a consumer, a natural person, in good faith, to pay all consumer debt without prejudice to an existential minimum.”

According to a monthly survey conducted by the National Federation of Goods, Services and Tourism Trade (CNC), The number of debt-burdened households in Brazil reached 69.7% in June The highest percentage since 2010.

See what changes in practice in the life of the consumer:

1- Fairer trading terms for those who borrow

Those who rent credit but are completely unable to meet their financial obligations, whether due to unemployment, illness or any other reason affecting the budget, will have better negotiating conditions.

“Today, every organization does what it wants, welcomes the consumer in any way, and makes agreements unfavorable for those burdened with debt. And that will change,” says Ione Amorim, economist and financial program coordinator at Idec.

According to Idec, studies show that in an effort to pay off these loans, many consumers end up incurring other debts.

“Passing the law will provide consumers, in addition to financial recovery, restoring their purchasing power and dignity, cutting the cycle of embarrassing fees and raising awareness about the use of credit,” the economist says.

By law, consumer safety is guaranteed before the debt becomes effective, as is Ban loan ads of type “without SPC consultation” Not assessing the financial condition of the consumer.

2- Elimination recovery

It will be possible to renegotiate the debt with all creditors at the same time. The idea is to ensure a fairer deal for consumers, as happens when companies file for bankruptcy. An indebted person may request a judicial authority to initiate the contract review process and provide a payment plan for a maximum period of five years.

In the absence of an agreement, the judge can establish a mandatory judicial plan for the consumer and debtors, fixing deadlines, amounts and forms of payment, while respecting the minimum survival for the consumer.

3- Ensuring an existential minimum.

The minimum income a person must pay for basic expenses cannot be used to pay off debts. who – which This measure prevents consumers from taking on new debt to pay basic bills, such as water and electricity.

“The idea is not to encourage default, but to pay the debt with a portion of the pay, without taking advantage of the debtor,” says Ioni.

The new law specifies that Banks are prohibited from hiding the real risks of getting a loan. It sounds obvious, but it isn’t always done. right Now, Banks, lenders, and any institution that sells in installments are required to report the total costs of contracted credit. Information such as interest, fees, charges, and overdue costs must be communicated in advance.

Idec warns: if the bank fails to deliver a copy of the contract with this information, this is an illegal practice and the consumer can claim their rights.

5- Ending customer harassment and pressure

With the law, if It makes any kind of harassment or pressure illegal to seduce consumers, including a prize, for example. Mainly for the elderly, the illiterate and the weak.

According to Idec, anyone who feels pressured during the hiring process can say no and should denounce the bank. The complaint can be submitted to the manager or the institution’s call center. If the problem is not resolved, the person should speak to the ombudsman and file a complaint with the central bank.

For the law to prevail and actually be respected, the central bank and entities, such as attorneys and public defenders across the country, will need to undergo training to regulate the new rules and provide the correct reception to the consumer. For Ione, from Idec, it will be necessary to adopt standards for the law to be effective.

7- More financial education

The change in the law provides more tricks for the consumer to be informed and understand exactly the pros and cons when taking out a loan.

“The new law values financial education, encourages conscious consumption and allows access to financial resources in a sustainable way. In a period like this we live in, and we are still affected by the pandemic, a country with legal tools to fight back,” says Elias Sfeir, president of the National Association of Credit Bureaus (ANBC). Excessive indebtedness provides more favorable conditions for the sustainable recovery of the economy.

Bolsonaro Refusal of the project department that determined the invalidity of the contract terms regarding the provision of products or services based on foreign laws that limit the force of the Brazilian Consumer Protection Act.

The President also vetoed the provision limiting the amount of credit premiums deducted from payroll to 30% of monthly wage and vetoed the provision that, in offering payroll deductible loans, forbids references to terms such as “interest-free” or “zero rate.”

a Brazilian Institute for Consumer Protection (Idec) He says these are important points that still benefit banks in offering loans discounted from payroll, but he considers the approval a victory.

“With the veto, there are very superficial points in consumer protection, especially for seniors. But there is the potential to override the veto or fight for specific legislation on payroll deducted credit,” says Ioni Amorim.

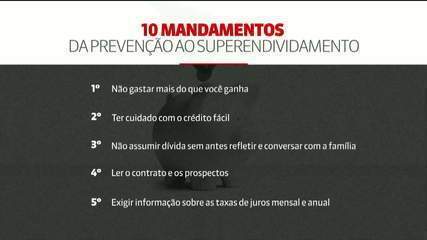

Learn how to recognize the signs of over-indebtedness and how not to fall into this situation